Some of us live in a world of dollars.

As opposed to pounds, or yen, or deutschemarks, we experience the everyday prices for goods and services in units of dollars.

Everything from our morning coffee, to rent, to our retirement savings is priced in terms of “how many dollar bills is this thing worth?”

Most of us don’t spend time thinking about the fact that a dollar bill is itself a commodity. It’s just one of those helpful abstractions that comes from thinking that a dollar bill is ‘money.’

This abstraction tends to unravel when, like this week, famous investors make public predictions that

“The Federal Reserve…will have to print more money to make up for the deficit, have to monetize more and…You easily could have a 30 percent depreciation in the dollar”

At Black Snow, while we don’t disagree with Ray’s logic that:

Fed Easing > Lower Interest Rates -> Debt Monetization -> Weaker Dollar

We do disagree with the timeline and path that the dollar may take.

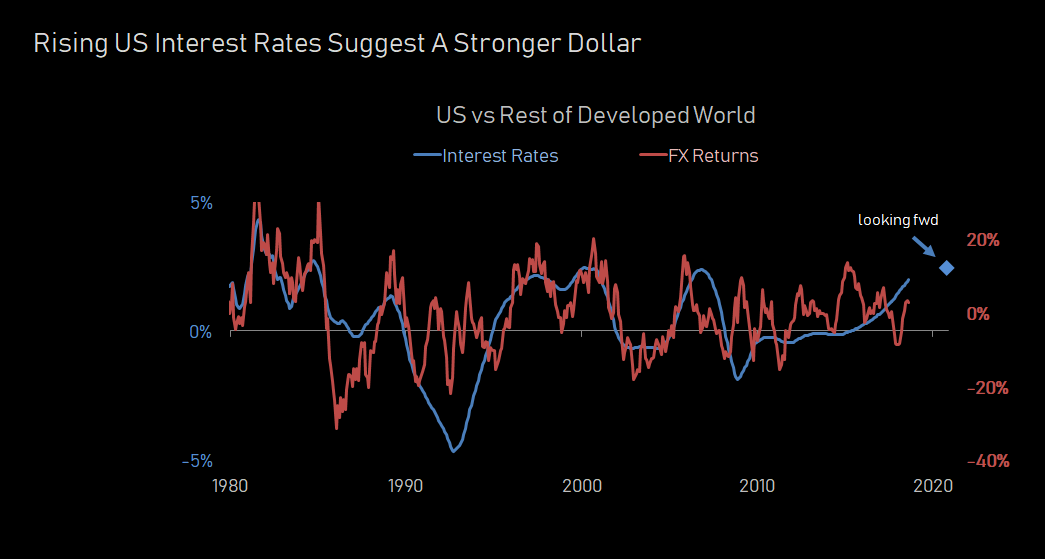

Given that the Fed is currently tightening (and most other major central banks are easing), the first order pressure on the dollar aught be to strengthen. It’s hard to see the dollar selling off that much in a world where a bank account in New York gets you 2% (and rising) more than a bank account in London, Tokyo or Frankfurt.

Further, when you think about what the world would need to look like to get the Fed to switch from tightening:

Everything is fine -> Raise Interest Rates -> Shrink the Fed Balance Sheet

To easing:

Everything is doomed -> Lower Interest Rates -> Buy Assets/Print Money

You need a mechanism by which global demand contracts and prompts a change in policy.

What’s the most likely cause of a contraction in global demand?

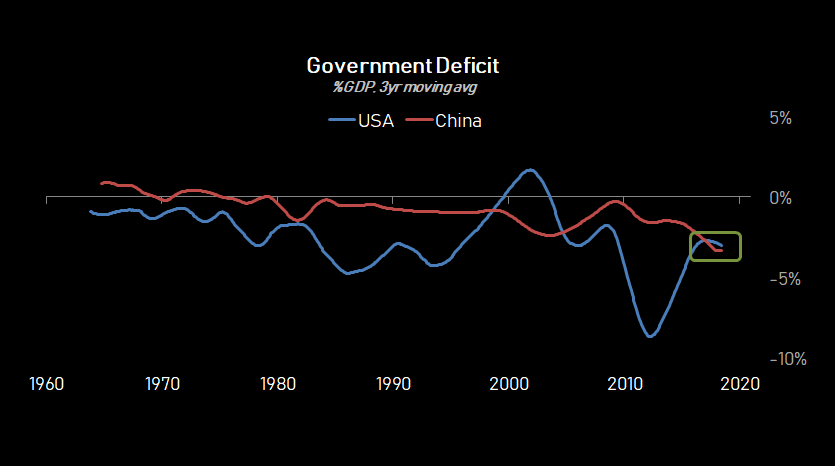

Yes, deficits in the US are large and unsustainable.

But it’s not like the US is the only one that needs to get it’s fiscal house in order.

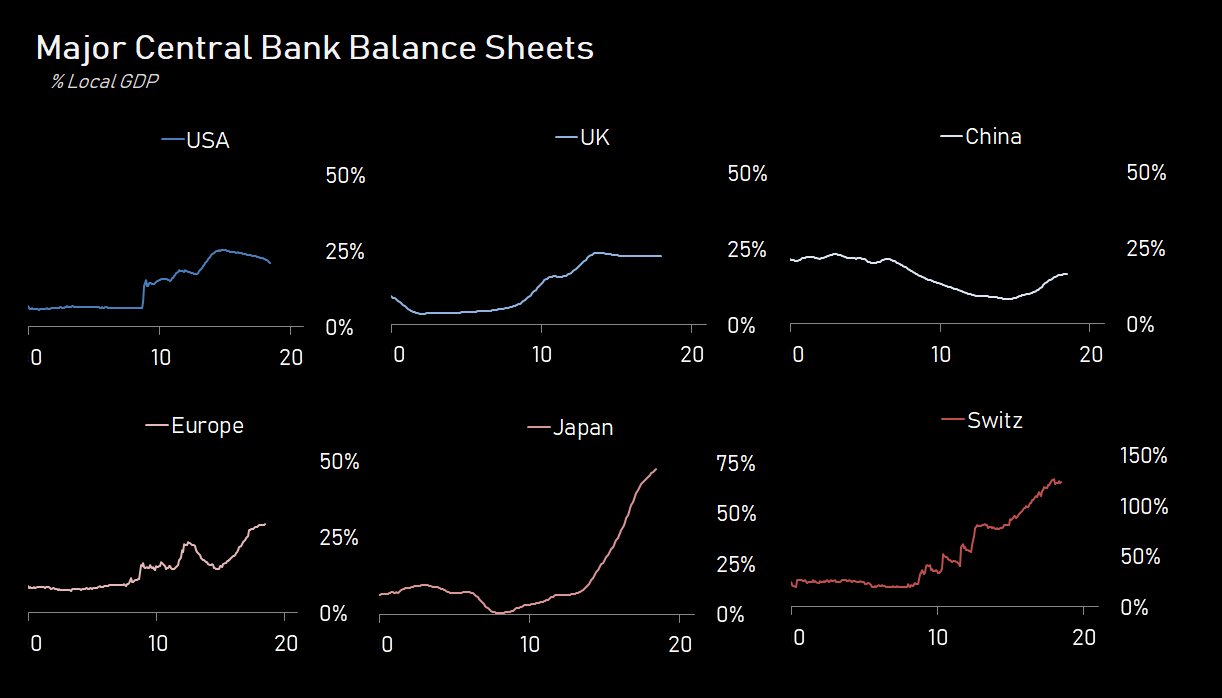

Yes, in the next downturn, the Fed will likely return to printing money.

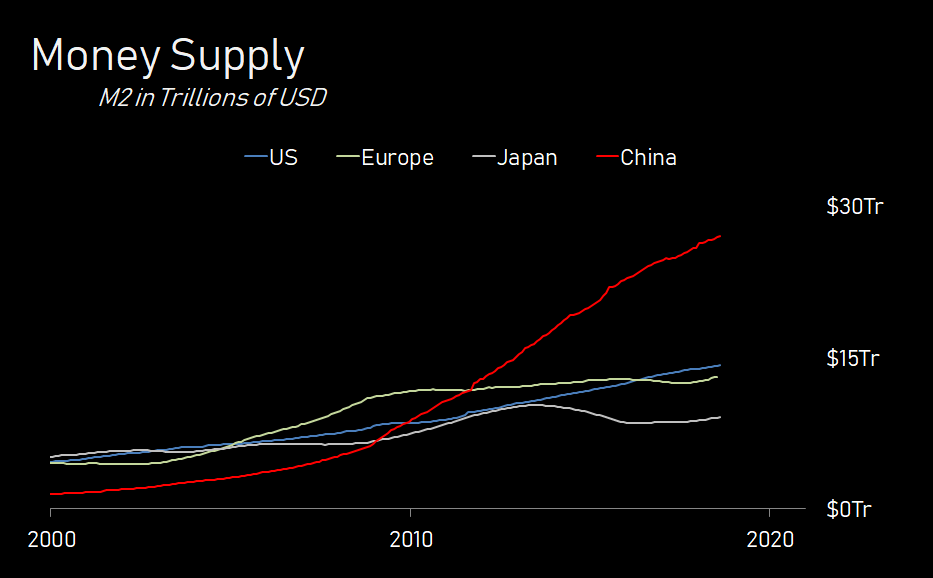

But when put in context of money printing in the rest of the world, it’s not like the US is the one that stands out.

*Central Bank Balance Sheets for Japan and China are ex-foreign currency reserves

Further, if you are worried about an unsustainable expansion in money, the US doesn’t seem like a prime candidate for worry.

So yes, we think it likely that in the next downturn, major central banks will print money to buy assets.

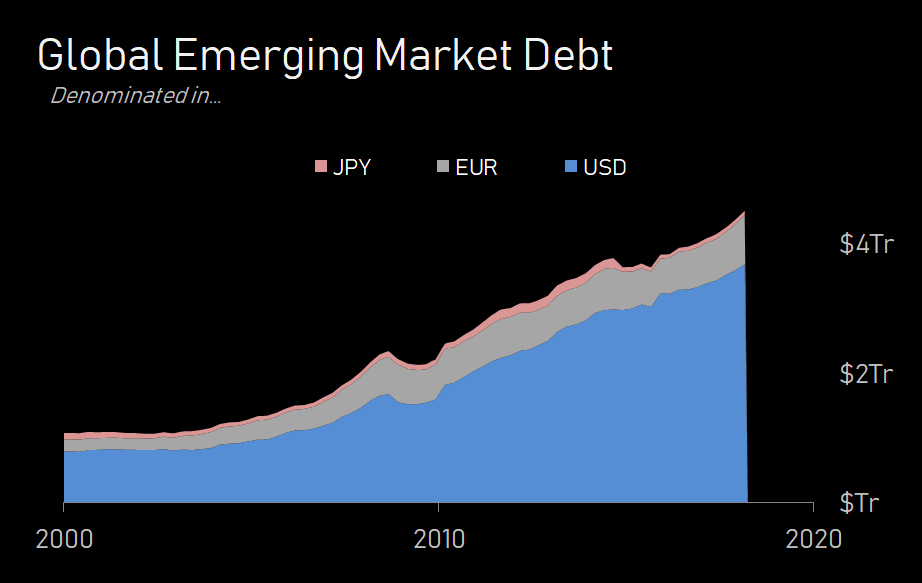

In the meantime, our view is that the relatively tight monetary policy by the Fed will lead to an appreciation in the dollar against most major currencies. That this stronger dollar will lead to the next downturn in the global credit cycle, as tightening in the reserve currency traditionally has.

Thus, we remain long dollars.

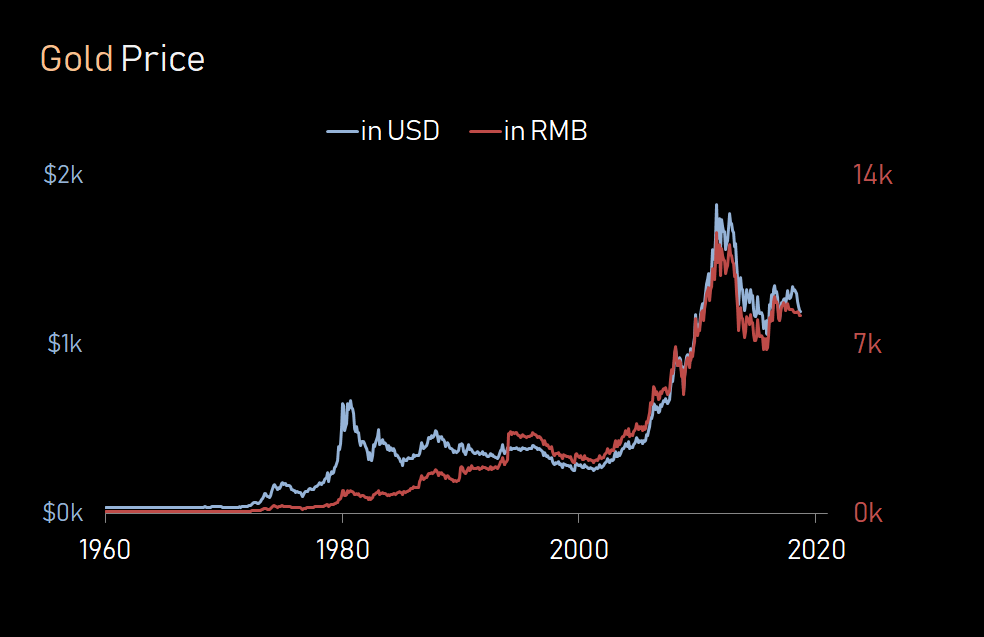

This downturn will likely see a broad depreciation of all paper currencies relative to real assets, as policymakers inject liquidity to local credit markets by printing money.

At that point, it will be less a story about dollar weakness in particular, and more a story of ‘which one’, ‘how much’ and ‘against what’….

We recommend gold (denominated in RMB) as a natural hedge for this eventually outcome.